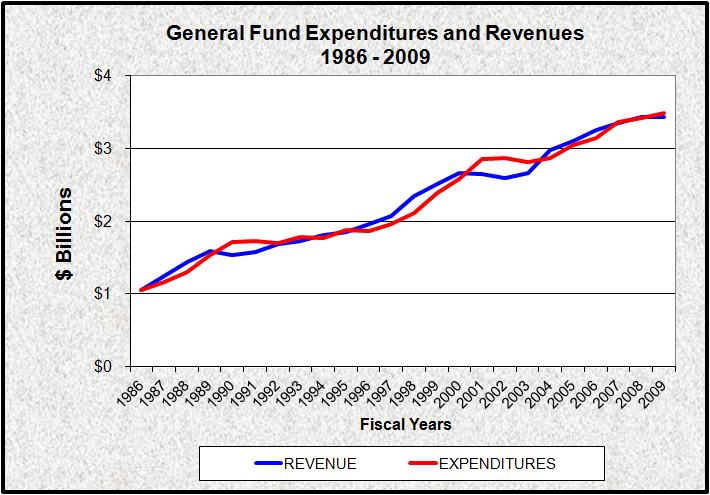

State Revenues and Expenditures 1986-2009

The General Fund accounts for most State expenditures, but excludes other special funds, the largest of which is the Highway Fund, supported primarily by motor vehicle fuel taxes and federal funds.

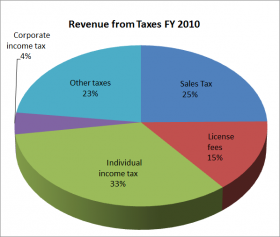

General Fund revenues in Maine have traditionally relied on taxes paid directly by individuals (income and sales 58% combined), with only a small portion, about 4%, paid by corporate income taxes.* In recent years the individual income tax has provided a greater share, while reliance on the sales tax has declined slightly.

In the early 1990’s and in the early 2000’s, revenues lagged expenditures leading to strong measures to close the gap. Otherwise, revenues have matched or exceeded revenues.

In 1982, the sales tax accounted for 38% of general fund revenue; in 2006, that portion was 32%. During the same period, individual income taxes grew from 31% to 48%.

A small portion of the total, cigarette taxes have increased substantially and in 2006 accounted for 5% of the General Fund total, up from 4% in 1982.

Beginning in the late 1990’s, over one hundred million dollars in “revenue sharing” have been returned to cities, towns and plantations across the state to assist with local government expenses and reduce property taxes.

*Fiscal Year 2010, Source: U.S. and state summary tables. http://www.census.gov/govs/state/ (accessed March 5, 2012)

2010 FY Revenue Sources

See other budget information: general, expenditures, State employees.